According to the "Semiconductor Manufacturing Monitor (SMM) Report for the Third Quarter of 2024" recently released by the International Semiconductor Industry Association (SEMI) in collaboration with TechInsights, the global semiconductor manufacturing industry achieved the first positive quarter-on-quarter (QoQ) growth in all key industry indicators in the third quarter of 2024 in two years.

The report points out that the investment needs of AI data centers have become the main driving force for the growth of semiconductor manufacturing. With the rapid development of AI technology and the wide diffusion of applications, the demand for high-performance computing, storage and data processing is rising, which directly stimulates the demand for semiconductor products. Particularly in the data center sector, the strong demand for memory chips, coupled with an overall increase in the price of memory products, further drove the growth of IC sales.

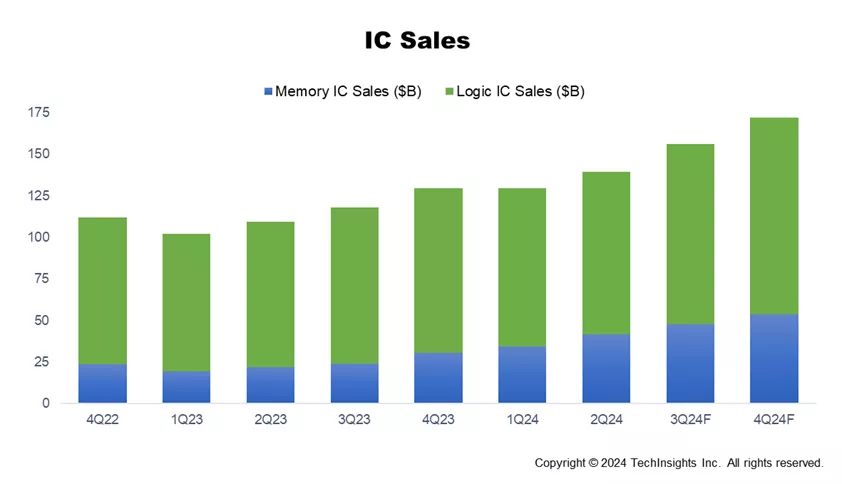

After a decline in the first half of 2024, electronics sales rebounded in the third quarter, growing 8% sequentially, and are expected to grow 20% sequentially in the fourth quarter. IC sales also performed well, growing 12% sequentially in the third quarter and are expected to grow another 10% in the fourth quarter. Overall, IC sales are expected to grow by more than 20% in 2024, driven primarily by memory products.

In addition, semiconductor capital expenditures (CapEx) declined in the first half of 2024, but turned positive from the third quarter. Memory-related capital expenditures increased 34% sequentially and 67% year-over-year in the third quarter, demonstrating a significant improvement in the memory IC market compared to the same period last year. Total capital expenditures in the fourth quarter are expected to increase 27% sequentially and 31% year-over-year, with memory-related capital expenditures growing at a 39% year-over-year rate.

The report points out that the investment needs of AI data centers have become the main driving force for the growth of semiconductor manufacturing. With the rapid development of AI technology and the wide diffusion of applications, the demand for high-performance computing, storage and data processing is rising, which directly stimulates the demand for semiconductor products. Particularly in the data center sector, the strong demand for memory chips, coupled with an overall increase in the price of memory products, further drove the growth of IC sales.

After a decline in the first half of 2024, electronics sales rebounded in the third quarter, growing 8% sequentially, and are expected to grow 20% sequentially in the fourth quarter. IC sales also performed well, growing 12% sequentially in the third quarter and are expected to grow another 10% in the fourth quarter. Overall, IC sales are expected to grow by more than 20% in 2024, driven primarily by memory products.

In addition, semiconductor capital expenditures (CapEx) declined in the first half of 2024, but turned positive from the third quarter. Memory-related capital expenditures increased 34% sequentially and 67% year-over-year in the third quarter, demonstrating a significant improvement in the memory IC market compared to the same period last year. Total capital expenditures in the fourth quarter are expected to increase 27% sequentially and 31% year-over-year, with memory-related capital expenditures growing at a 39% year-over-year rate.

The Products You May Be Interested In

|

CAR0424FPXXXZ01A | AC/DC CONVERTER 24V 400W | 394 More on Order |

|

CAR0812DCBX5Z01A | DC/DC CONVERTER 12V 850W | 252 More on Order |

|

AXH010A0D93-SR | DC DC CONVERTER 2V 20W | 495 More on Order |

|

SW003A0A94-SRZ | DC DC CONVERTER 5V 15W | 292 More on Order |

|

QPW060A0P641 | DC DC CONVERTER 1.2V 72W | 158 More on Order |

|

QPW050A0F1-HZ | DC DC CONVERTER 3.3V 165W | 431 More on Order |

|

EQW010A0B41-SZ | DC DC CONVERTER 12V 120W | 309 More on Order |

|

QRW035A0F1-H | DC DC CONVERTER 3.3V 116W | 120 More on Order |

|

NH020G | DC DC CONVERTER 2.5V 20W | 324 More on Order |

|

LW010AJ | DC DC CONVERTER +/-5V 10W | 307 More on Order |

|

LW010A4 | DC DC CONVERTER 5V 10W | 459 More on Order |

|

LW005A8 | DC DC CONVERTER 5V 5W | 394 More on Order |

|

JRW017A0B1 | DC DC CONVERTER 12V 204W | 320 More on Order |

|

JC030C-M | DC DC CONVERTER 15V 30W | 444 More on Order |

|

JBW050F1 | DC DC CONVERTER 3.3V 33W | 214 More on Order |

|

FW300A1 | DC DC CONVERTER 5V 300W | 140 More on Order |

|

EQW012A0A-S | DC DC CONVERTER 5V 60W | 387 More on Order |

|

QBVW025A0B41Z | DC DC CONVERTER 12V 300W | 169 More on Order |

|

EBVW020A0B1Z | DC DC CONVERTER 12V 240W | 153 More on Order |

|

ESTW036A0F41Z | DC DC CONVERTER 3.3V 120W | 208 More on Order |

|

ERCW003A6R41Z | DC DC CONVERTER 28V | 145 More on Order |

|

ATA006A0X4-SRZ | DC DC CONVERTER 0.8-5.5V 33W | 152 More on Order |

|

PNDT012A0X3-SRZ | DC DC CONVERTER 0.45-5.5V | 364 More on Order |

|

EBVW020A0B41Z | DC DC CONVERTER 12V 240W | 535 More on Order |

Semiconductors

Semiconductors

Passive Components

Passive Components

Sensors

Sensors

Power

Power

Optoelectronics

Optoelectronics